Give the Historic Tax Credit a boost!

The Federal Historic Tax Credit (HTC) is one of our most powerful preservation tools, providing owners of historic buildings with an incentive to invest in the rehabilitation of their properties. Over 20 cities and towns in Washington State have benefited from this program in the last 15 years and more upcoming projects are relying on the HTC.

Throughout 2017, the Washington Trust and our partners worked hard to ensure the HTC survived the tax reform process. While the 20 percent credit was maintained in the final tax reform bill, the program was modified, requiring the credit to be taken over 5 years. This reduces the overall value and impact of the HTC.

In June, Representatives LaHood (R-IL) and Blumenauer (D-OR), along with Senators Cassidy (R-LA) and Cardin (D-MD), introduced the Historic Tax Credit Enhancement Act (H.R. 6081 and S. 3058) to allow property owners to claim their credit in the first year. Enacting this legislation will strengthen the credit for building owners who are revitalizing historic properties in communities nationwide (or thinking about it!) and improve how the credit pairs with other economic development programs.

TAKE ACTION! As the 115th Congress winds down, please reach out to your Members of Congress and ask legislators to include the Historic Tax Credit Enhancement Act bill in year-end legislation!

Find your Representative in the House

Talking Points:

- The Federal Historic Tax Credit (HTC) provides owners of historic buildings with an incentive to invest in the difficult task of rehabilitating their properties according to the Secretary of Interior’s Standards for Rehabilitation.

- While the 20 percent historic tax credit was maintained in the final tax reform bill, it was modified, reducing the amount of reinvestment flowing into our historic communities and neighborhoods.

- Presently, the tax code requires that building owners subtract the amount of HTCs from a building’s basis (the amount a property is worth for tax purposes). Eliminating this requirement will increase the basis of rehabilitated historic buildings for building owners, provide additional tax benefits, and attract more capital from tax credit investors. Rep. LaHood (R-IL), Rep. Blumenauer (D-OR), Sen. Cassidy (R-LA), and Sen. Cardin (D-MD) have introduced the Historic Tax Credit Enhancement Act (H.R. 6081 and S. 3058) to eliminate the basis adjustment for federal HTC transactions.

- This legislative change would preserve the vast majority of savings achieved by the Tax Cut and Jobs Act and bring the HTC in line with the Low-Income Housing Tax Credit, which does not require a basis adjustment.

- Enacting this legislation will strengthen the credit and improve the incentive for building owners who are revitalizing historic properties in communities nationwide and improve how the credit pairs with other economic development programs such as the Low-Income Housing Tax Credit and new Opportunity Zone incentive.

- Please co-sponsor the Historic Tax Credit Enhancement Act, sponsored by Cassidy/Cardin in the Senate (S. 3058) and LaHood/Blumenauer in the House (H.R. 6081) and support including this bill in year-end legislation.

Thank you for helping to save the Federal Historic Tax Credit in 2017!

Stirrings over tax reform have been rumbling through Washington, DC for several years, but in 2017, Congress began to seriously dive into legislative efforts to overhaul the nation’s tax code. To the alarm of preservationists across the country, the “blueprint” for national tax reform called for repeal of the Federal Historic Tax Credit, or HTC. Established over 40 years ago, the HTC encourages owners of historic buildings to engage in rehabilitation activities in exchange for credit against their federal income tax. The program is widely touted as being the most effective tool for private investment in historic properties nationwide, attracting over $131 billion in private capital since inception.

Fear became reality when the tax plan passed by the House of Representatives in November failed to retain the HTC. Preservationists mobilized, engaging in a nationwide effort to educate legislators on the economic power and cultural importance of the program. Thankfully, the Senate’s version of the tax reform bill passed in December included the HTC and through the heroic national effort put forth by preservation advocates, the HTC survived in the final tax bill signed into law on December 22, 2017.

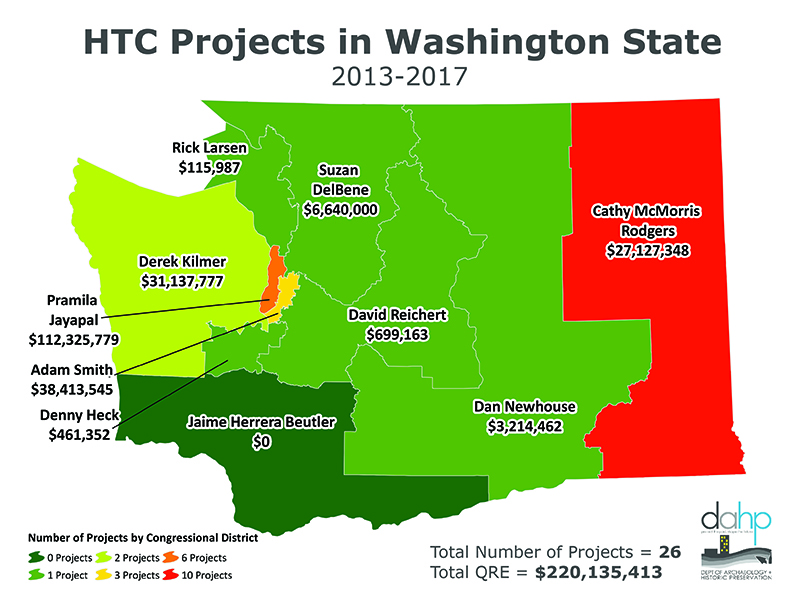

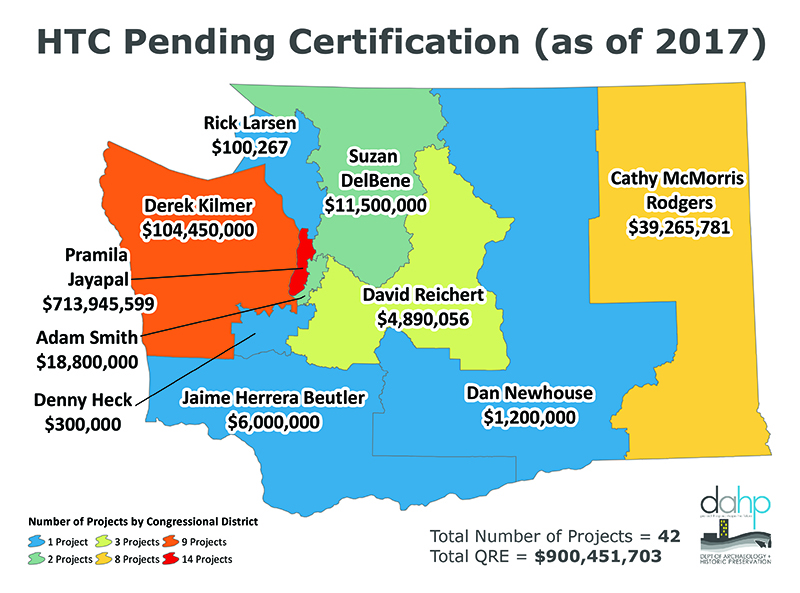

In Washington State alone, there are over 40 rehabilitation projects representing $900 million in capital investment that have recently been completed or are currently under way, including the Elks Building in Wenatchee, the Publix Hotel in Seattle’s International District, and Cheney High School in Cheney, and many of these projects would not have occurred without the HTC. The Washington Trust is proud of our role in galvanizing support among our constituents to save this program and we are indebted to our colleagues at the Washington State Department of Archaeology & Historic Preservation for providing critical data on tax credit projects and helping to educate policymakers.

We are also grateful to our entire Washington State congressional delegation, especially Representatives Dave Reichert and Suzan DelBene, both of whom serve on the Tax Policy Subcommittee of the House Ways & Means Committee; and to Senators Maria Cantwell and Patty Murray, both of whom served on the Joint Congressional Committee established to resolve differences on tax reform. While the bill ultimately passed along a party-line vote, Washington’s congressional delegation on both sides of the aisle understood the importance of this program..

Tax Credit Maps by Congressional Districts

Historic Tax Credit Facts

- The Federal Historic Tax Credit has created more than 2.4 million jobs and leveraged $117 billion in private investment.

- The Historic Tax Credit has returned $1.25 for every $1 invested.

- In Washington alone, the Historic Tax Credit has made 28 projects possible since 2012, totaling $291 million in direct rehabilitation investment.

- The Federal Historic Tax Credit program is essential. It is often the difference between projects getting done or being stalled.